Darden Releases New Case Study (Taylor’s Version)

Darden Business Publishing Offers Case on Master Recording Valuation

Taylor Swift’s right to control the master recordings of her first six albums has resonated in popular culture since the controversy began in 2019, when Scooter Braun purchased Big Machine Records, Swift’s original label. As the songwriter, Swift owned the publishing rights to her songs, but the label owned the performances captured on the recordings, and Swift’s antipathy to Braun was strong. She called his ownership “my worst case scenario.” But less than two years later, Braun was looking to sell.

Beyond the controversy, any potential acquirer had to deal with several factors creating uncertainty as to the future value of the recordings:

Photo: Shutterstock / Tinseltown. Taylor Swift won six awards at the 2022 American Music Awards, including two for her re-recorded album Red (Taylor’s Version).

- Were fundamental changes still ongoing in the music industry after years of upheaval, or were costs and revenues generally predictable?

- Would Swift go through with her plans to re-record the albums when she had the contractual right to do so, creating new “Taylor-approved” versions of the songs? How would Swift’s legendarily loyal fans respond knowing how important the case was to the artist?

- If she did indeed re-record, how much value would the originals have? Would they lose value, and if so by how much? How would re-recording adjust the value allocated to Swift?

- With Braun no longer the rights-holder, would Swift be amenable to a partnership with new ownership, which could not be discussed prior to the sale? What could such a partnership look like?

The new case, “Shamrock Capital: Pricing the Masters of Taylor Swift” provides the opportunity to delve deeply into both the human and business factors that Shamrock Capital had to consider when making the purchase.

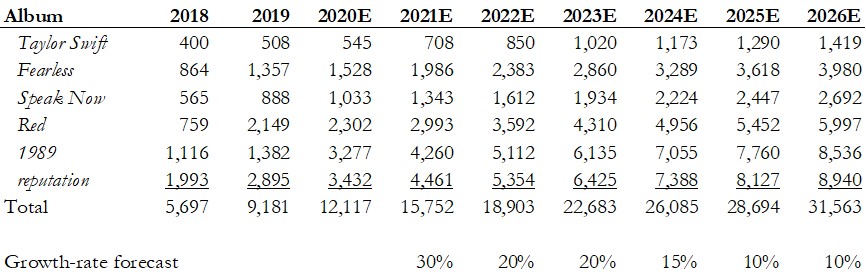

Estimated Number of Global Streams across All Platforms by Year for Swift Masters (in millions)

Source: Case author estimates based on data reported by Spotify and analyst forecasts

“I want to thank Professor Michael Schill for his constant support for this project” said the case’s author Kelcie Schofield (MBA ’23). “His guidance helped make a Taylor Swift-centric finance case a reality.”

For Darden students, and others who engage with the case, the collision of interests, assets and celebrities offers an engaging opportunity for financial decision-making in conditions of uncertainty. The case is particularly effective at introducing firm valuation technique and serves as the introductory case for Darden’s course Valuation in Financial Markets.

The University of Virginia Darden School of Business prepares responsible global leaders through unparalleled transformational learning experiences. Darden’s graduate degree programs (MBA, MSBA and Ph.D.) and Executive Education & Lifelong Learning programs offered by the Darden School Foundation set the stage for a lifetime of career advancement and impact. Darden’s top-ranked faculty, renowned for teaching excellence, inspires and shapes modern business leadership worldwide through research, thought leadership and business publishing. Darden has Grounds in Charlottesville, Virginia, and the Washington, D.C., area and a global community that includes 18,000 alumni in 90 countries. Darden was established in 1955 at the University of Virginia, a top public university founded by Thomas Jefferson in 1819 in Charlottesville, Virginia.

Press Contact

Molly Mitchell

Senior Associate Director, Editorial and Media Relations

Darden School of Business

University of Virginia

MitchellM@darden.virginia.edu