Economic Experts Put the ‘Biden Economy’ in Focus

By Dave Hendrick

U.S. policymakers and consumers are grappling with a deeply unsettled and unusual economy, with positive trajectory in key metrics such as unemployment, corporate earnings and consumer wages progressing alongside the ongoing threat of the coronavirus pandemic, geopolitical turmoil and a sharp increase in inflation.

UVA Darden Professor Scott Miller

A group of leading economic thinkers in late March considered the unprecedented path to the 2022 economy at an event sponsored by the University of Virginia’s Miller Center and moderated by Darden Professor Scott Miller. The economy is by many measures quite good, they generally agreed, and yet supply and demand remain deeply incongruent and consumers are facing ongoing hardships from rising prices.

It can be easy to forget, said Vox.com cofounder and writer Matt Yglesias, that we are emerging from a two-year global pandemic.

Two years ago, the notion that March 2022 would feature a U.S. economy with relatively low unemployment, strong household balance sheets and rising wages would have seemed overly optimistic, he said. Yet consumer sentiment has fallen considerably in the last year, as many feel the “deterioration in real income.”

With inflationary pressure and supply chain woes likely to continue, consumer sentiment will probably remain depressed in the short-term.

Indeed, Stephen Rattner, the Willett Advisors CEO who led the restructuring of the automobile industry under the Obama administration, said it was clear that inflation is a “particularly pernicious force in the minds of American consumers.” So whatever positive markers consumers may see in the economy, they are being outweighed by the rising cost of goods and services.

UVA Darden Professor Kinda Hachem

Darden Professor Kinda Hachem noted that while inflation had clearly risen, it was important to consider the comparative baselines. Core inflation of six percent in January 2022 was calculated against a baseline of January 2021, when consumer activity remained depressed due to the ongoing coronavirus pandemic. The better gauge, Hachem said, would be to compute an annualized rate against January 2020. At roughly 3.7 percent, this figure is still higher than the Federal Reserve’s target but “not as stunning” as six percent.

While it is important for the Fed to show that they have the ability to rein in inflation, Hachem added, it’s unlikely we’ll see dramatic interventions along the lines of those led by former Federal Reserve Board Chairman Paul Volcker, who led a sustained increase in the federal funds rate, curbing inflation while sparking a recession.

“Inflation is a problem, but from a macro perspective, nowhere near the type of environment where we needed a multiyear recession to rein it back in,” said Hachem.

Moreover, Hachem noted Volcker “inherited a Fed that was suffering from a credibility problem,” charged with frequently bowing to political pressure. Although the current Fed must take inflation seriously and demonstrate a willingness to address it, the institution is in a far better position than the one Volcker took over, she said.

Rattner, however, said he did believe interest rates would need to be “much higher” if the fed hopes to tame inflation, risking a recession along the way.

So, how did we get here? Part of the explanation is simple supply and demand. Yglesias noted that the massive stimulus programs launched throughout the COVID-19 pandemic left many households flush with money, leading to huge amounts of demand and supply still struggling to catch up.

Hachem noted, too, that the Federal Reserve’s stated intention of spurring “inclusive growth” made clear that they were willing to tolerate some inflation higher than typical targets in order to see growth metrics shared across socioeconomic boundaries.

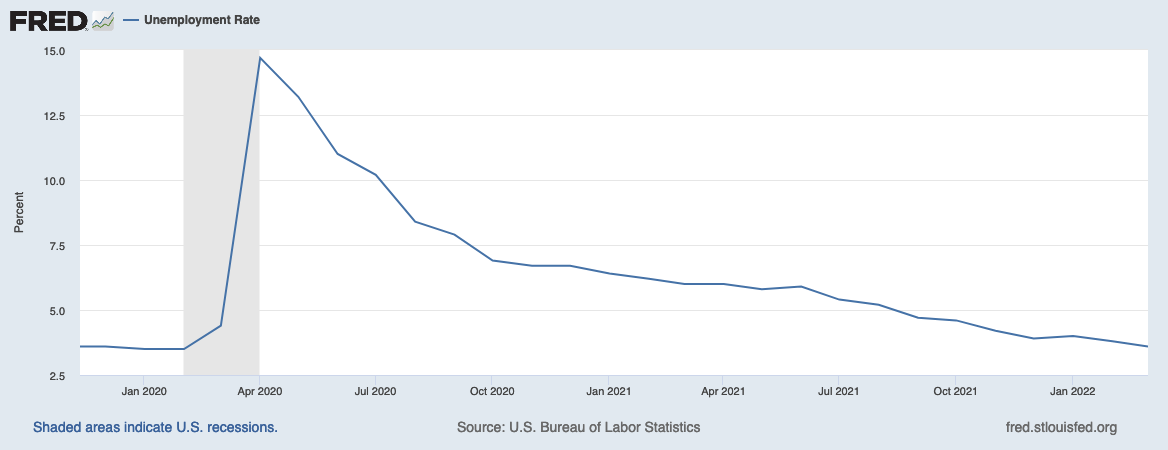

Yglesias said the Fed and other policy makers “clearly need a course correction away from stimulus,” noting that initial pandemic policies were designed to address “massive unemployment.” With the unemployment rate hovering around four percent, however, this is obviously no longer an appropriate goal, he said.

With an ongoing war certain to further hamper global supply chains and inflation clearly front of mind for American consumers, the Fed and policymakers are facing “multifaceted problems that can only be partially solved.”

The University of Virginia Darden School of Business prepares responsible global leaders through unparalleled transformational learning experiences. Darden’s graduate degree programs (MBA, MSBA and Ph.D.) and Executive Education & Lifelong Learning programs offered by the Darden School Foundation set the stage for a lifetime of career advancement and impact. Darden’s top-ranked faculty, renowned for teaching excellence, inspires and shapes modern business leadership worldwide through research, thought leadership and business publishing. Darden has Grounds in Charlottesville, Virginia, and the Washington, D.C., area and a global community that includes 18,000 alumni in 90 countries. Darden was established in 1955 at the University of Virginia, a top public university founded by Thomas Jefferson in 1819 in Charlottesville, Virginia.

Press Contact

Molly Mitchell

Associate Director of Content Marketing and Social Media

Darden School of Business

University of Virginia

MitchellM@darden.virginia.edu