2023 Economic Forecast: Recession Likely, but How Bad Will It Be?

By David Hendrick

Those looking for a crystal clear outlook at the annual economic forecast event at the University of Virginia Darden School of Business came to the wrong place.

Too many variables, too much uncertainty in a world racked by inflation, war and a lingering pandemic, among countless other wild cards, in the U.S. and abroad.

“It’s not possible to forecast what’s going to happen, even for the year,” said Professor Alan Beckenstein, who leads the annual event, which is hosted by the Richard A. Mayo Center for Asset Management, alongside Darden lecturer and economist Nick Sargen. “The number of global shocks we have had since 2020 have been enormous. It’s complete chaos.”

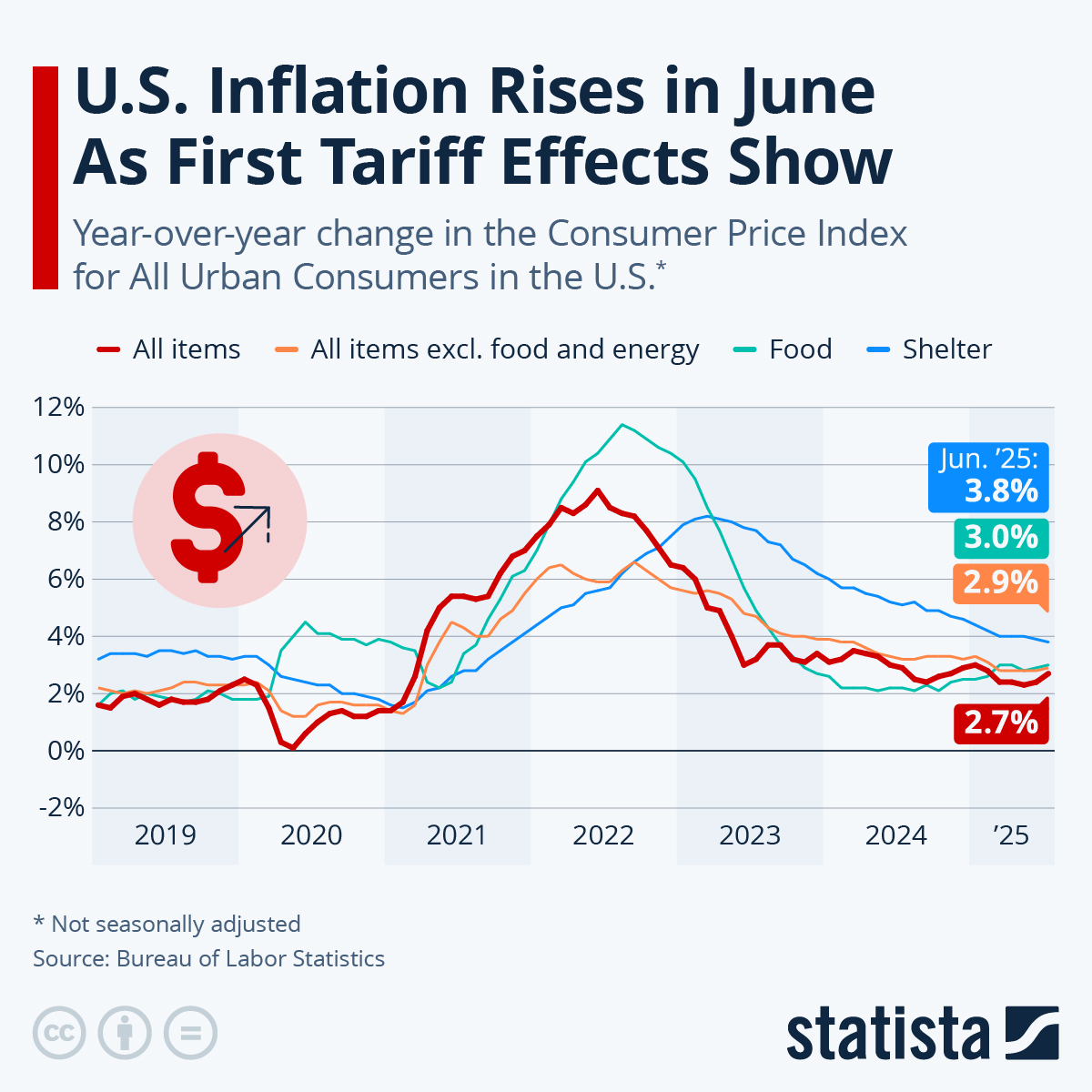

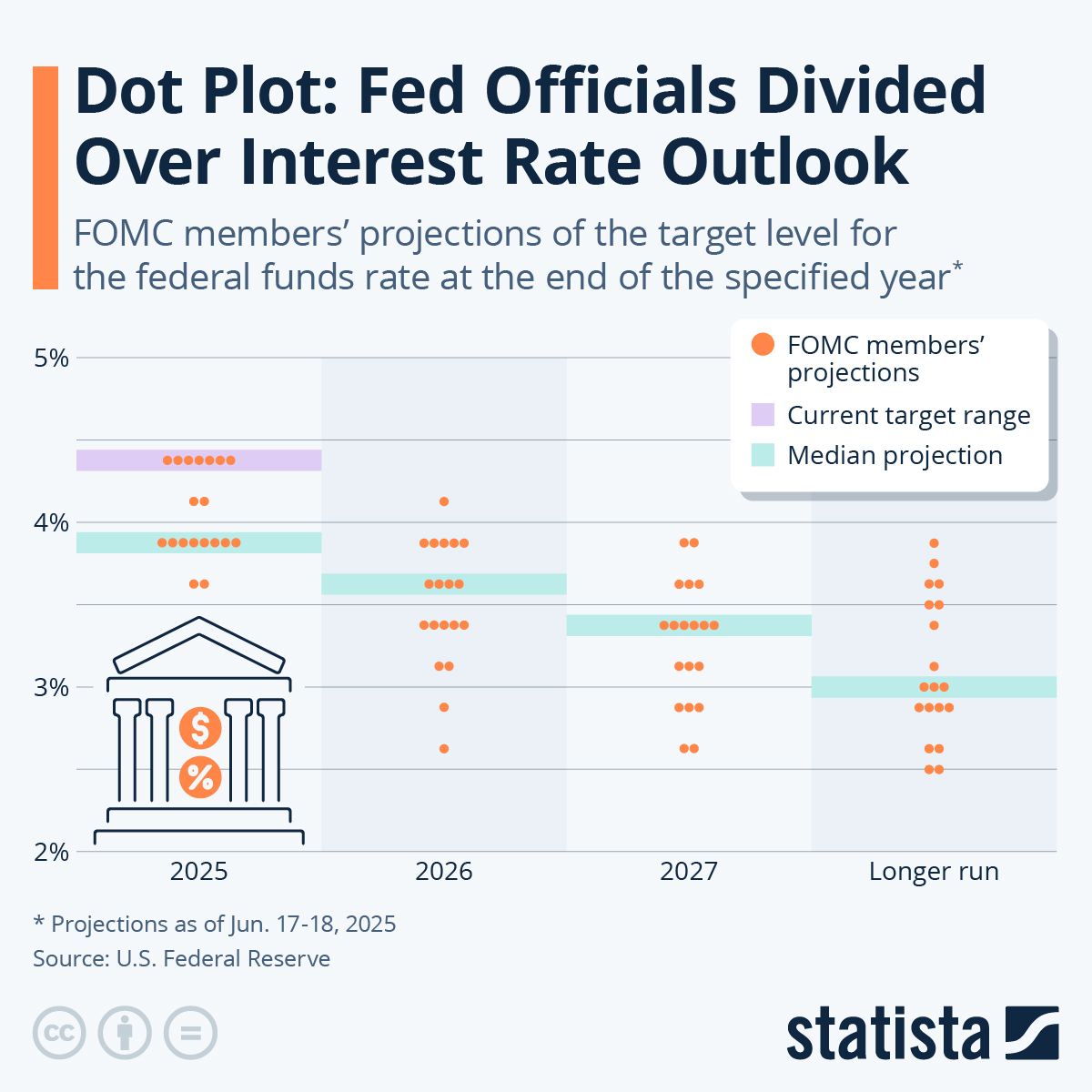

Amid the chaos, the Federal Reserve continues to attempt to reduce the inflation by raising interest rates and slowing the economy; it’s unclear how high rates will go, and how much the economy will slow. The Fed is in the precarious possession of attempting to tame inflation without sparking a severe recession.

“There will be a recession,” Beckenstein said. “The question is: will there be a soft landing?

Markets remain distorted by 12 years of zero percent interest rates, and the path back to normalcy remains unclear.

And for investors? Sargen, who also serves as senior economic advisor for Fort Washington Investment Advisors, likened traditional forecasting to betting on a number on the roulette wheel. The more prudent approach is to simply to decide whether to play red or black, he said; for an investor in the current context, that means trying to figure out what markets are currently pricing in, and making a decision on whether to bet the over or under.

After a year in which bond and equity markets showed dramatic declines, much negative sentiment has already been priced in. But if there is a case for a bounce, it’s hard to see in the current climate, Sargen said.

Sargen said inflation appears to have peaked, especially on goods, but remains elevated in services and any perceived stickiness could lead to continued increases in interest rates. Bond markets appear to believe the fed will lower rates in the second half of the year, Sargen said, and equity investors will be watching earnings reports for signs of positive momentum. Ample downside risk remains, however.

Sargen said he doesn’t have a strong inclination as to the likely direction for equity markets for the year, although stock markets appear to have priced in “very sluggish earnings.”

The nature of a potential recession will play a role, as well. Like Beckenstein, Sargen said a recession is likely, but barring unforeseen shocks, in all likelihood it will be a “garden variety” one, as opposed to the Great Financial Crisis or the COVID crisis at its outset.

“If inflation has peaked, that gives some comfort that the Fed will take foot off brake at some point,” said Sargen. “But what is the case for a steep rebound?”

Interest rates are not going back to zero, Sargen said, and stimulus packages seem off the table in a divided government.

“I think we are going to be going sideways for a protracted period, rather than classic V shape,” Sargen said.

Beckenstein concluded by noting that a modest recovery could be impacted by any number of unforeseen shocks, including environmental calamity and escalating geopolitical events.

The Mayo Center and the Darden Office of Engagement will host additional Economic Forecast events on 10 February and 17 February.

The University of Virginia Darden School of Business prepares responsible global leaders through unparalleled transformational learning experiences. Darden’s graduate degree programs (MBA, MSBA and Ph.D.) and Executive Education & Lifelong Learning programs offered by the Darden School Foundation set the stage for a lifetime of career advancement and impact. Darden’s top-ranked faculty, renowned for teaching excellence, inspires and shapes modern business leadership worldwide through research, thought leadership and business publishing. Darden has Grounds in Charlottesville, Virginia, and the Washington, D.C., area and a global community that includes 18,000 alumni in 90 countries. Darden was established in 1955 at the University of Virginia, a top public university founded by Thomas Jefferson in 1819 in Charlottesville, Virginia.

Press Contact

Molly Mitchell

Associate Director of Content Marketing and Social Media

Darden School of Business

University of Virginia

MitchellM@darden.virginia.edu